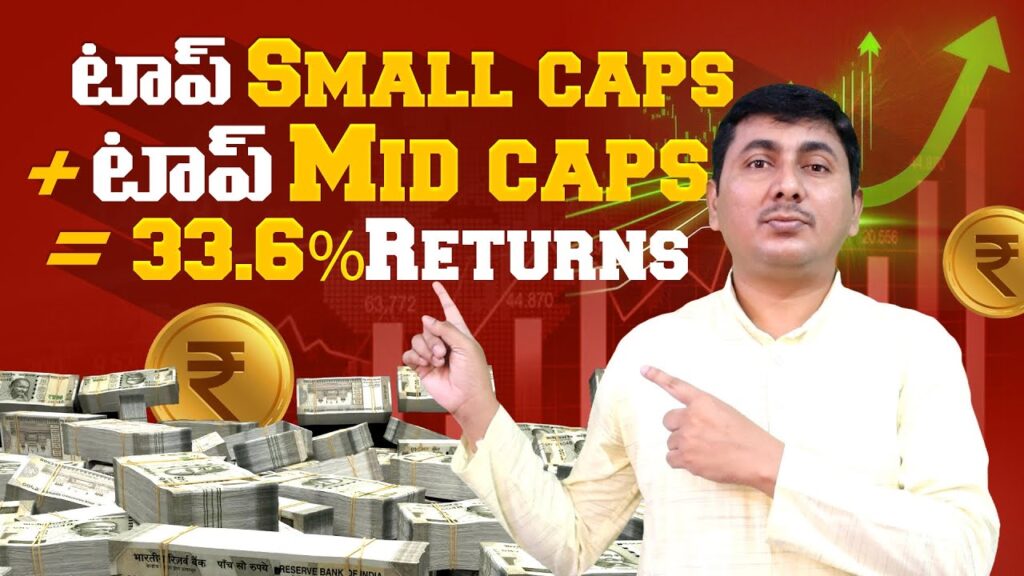

Small Caps vs Mid Caps vs Large Caps | ICICI Prudential Life NFO | Best ULIP

Check out more details about ICICI NFO👇

**📈 Invest Smart: ICICI Prudential Life NFO Explained | Midsmallcap400 Momentum Quality 100 Index Fund**

🎯 **Are you ready to make informed investment decisions?**

In this video, we answer two important questions:

1️⃣ Which are the top 3 safest banks in India?

2️⃣ Which shares—large caps, mid caps, or small caps—offer the highest returns?

Learn how the **ICICI Prudential Life NFO – Midsmallcap400 Momentum Quality 100 Index Fund** offers a unique investment strategy. This fund replicates an index designed for **long-term capital growth** by selecting high-quality, high-momentum mid and small-cap stocks.

🚀 **What you’ll discover in this video:**

✅ The benefits of investing in the **Midsmallcap400 Momentum Quality 100 Index Fund**

✅ How this fund avoids fund manager bias for consistent, high returns

✅ Tax benefits, life cover, and triple protection in case of unforeseen events

✅ Investment potential for NRIs to contribute to India's growth

💰 **Returns to know:**

– 5-year CAGR: **33.6%**

– 10-year CAGR: **22.5%**

– Invest ₹1,00,000 in 2014? It’s now worth ₹7,60,000!

💡 **Why ICICI Prudential Life?**

Backed by ICICI Bank and Prudential Corporation, this company has **₹3,20,000 crores in AUM** and a legacy of financial stability.

📅 **Act Fast!**

The NFO closes on **December 1, 2024**. With a minimum investment of just ₹2,500/month, secure your financial future today.

🔔 Don’t miss this industry-first opportunity. Watch the video and make your money work for you!

ICICI Prudential Life NFO, Top 3 safest banks in India 2024, Best small-cap funds to invest in 2024, Nifty Midsmallcap 400 Momentum Quality 100,

High-return investment strategies in India, ICICI Prudential Midsmallcap 400 index fund, How to invest in ICICI Prudential NFO, Small-cap vs Mid-cap vs Large-cap returns, Best ULIP plans in India with triple benefits, Best ULIP Plan 2024, Section 80C tax benefits explained, ICICI Prudential Life Signature Assure Plan, Investing for NRIs in India 2024, Top-performing funds for long-term growth, ICICI Prudential Life Insurance review, ULIP, Best ULIP

#ICICINFO #WealthCreation #InvestmentStrategy #MidSmallCap #IndexFund

Check out more details about ICICI NFO👇

https://tinyurl.com/2xumbhcu

Mutual funds tho compare cheste Ulip plans lo ekkuva charges cut avutayi ani vinnam and returns kuda takkuva ga untayani antunnaru,meeru enduku promote chestunnaro cheptara sir

Next video – comparison

Saami etf vedio saami na saaami 😂

Good Explanation Sir❤🎉❤🎉❤🎉

ETF video radhu ika anthega

Radhu

Mee way of explanation chala clear ga untadi, thank you 😊

ETF BIGINERS ELA CHEYALI VEDIO CHEYANDI SIR PLZ

ETF గురించి చెప్పండి

Please explain etf monthly income and taxes live demo 😅

Etf gurinchi next video eppudu sir

etf strategy cheppandi

ETF గురించి చెప్పండి sir మంత్లీ returns ఎలా ఉంటాయి. Charges ఎలా ఉంటాయి please చెప్పండి

Sir meeeu eft video chestara cheyara kaneesam adana chepandi

Sr good morning

Naku ME daggers assistant GA vundi Chala vishayalu nerchukovalani vundi

Sir,

Why This fund NFO not showing in Groww, angel oneapps ?

Please respond

Ulip plans are available only in policy bazar

@@bulletbhai143 sir

This NFO is not available also in icici pru amc.

It’s not a Mutual Fund . it’s a market linked Insurance plan

Expense Ratio very much higher than Mutual Funds. Administration Expenses+ Mortality Charges are high. Appropriately 7-10% Expenses will be levied by the fund